are hoa fees tax deductible for home office

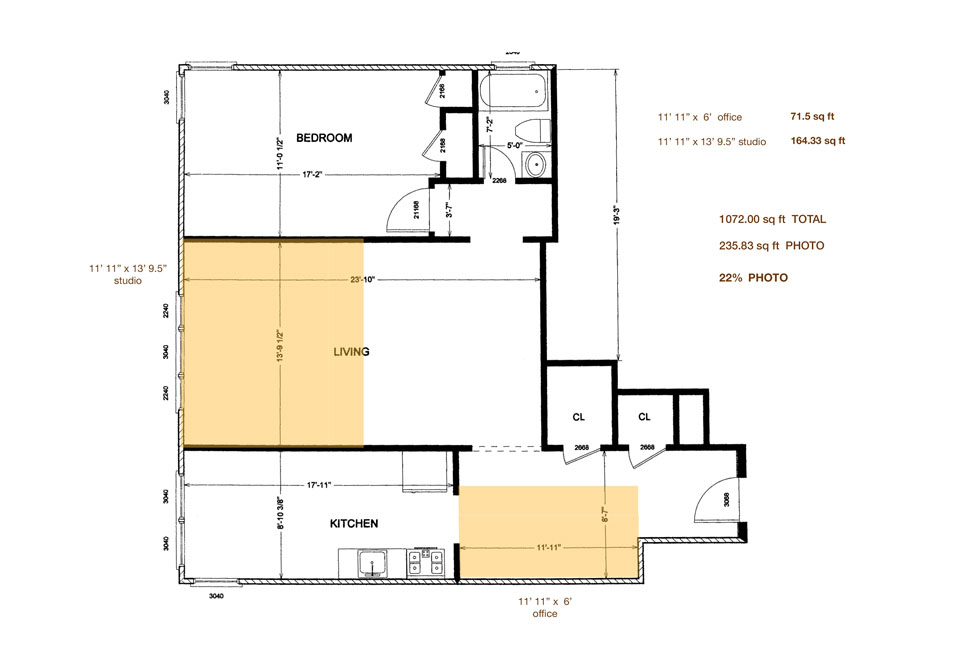

Ad Check For The Latest Updates And Resources Throughout The Tax Season. If you use part of your home as an office you can deduct part of your home expenses including the fees.

Are Hoa Fees Tax Deductible Clark Simson Miller

However there are some exceptions to this rule.

. Yes the prorated amount of the maintenance fees that apply to your home office are tax deductible. If you use 15 percent of your home as a home office then youd only be able to deduct 15 percent of your HOA fees. 4 Ways Your Tax Filing Will Be Different Next Year.

With more people working from home than ever before some taxpayers may be wondering if they can claim a home office deduction when they file their 2020 tax return next. With more people working from home than ever before some taxpayers may be wondering if they can claim a home office deduction when they file their 2020 tax return next. This is an exception to the rule.

So if your HOA dues are 4000 per year and you use 15 percent of your home as your permanent place of business you could deduct 15 percent of 4000 or 600. Ad Deductions for Healthcare Mortgage Interest Charitable Contributions Taxes More. Unfortunately homeowners association HOA fees paid on your personal residence are not deductible.

Get 1-on-1 Answers Online 24 Hours a Day. The IRS considers HOA fees as a rental expense which means you can write them off from your. HOA Law Experts Are Waiting to Help.

Yes you can write off HOA fees if you use your home as an office. Airbus stock price. The office bar and grill yelp.

If the use of the home office is merely appropriate and helpful you cannot deduct expenses for the business use of your home. For any home office to be deductible you must. This guideline also applies if you merely have a small home office.

June 4 2019 1136 PM. Association HOA fees paid on your personal residence are not deductible. Are HOA fees tax deductible Turbotax.

Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. In general HOA fees are considered a part of your monthly housing costs and are not tax deductible. The quick answer to the question are.

Ask a Lawyer Now. Any percentage used in conjunction with this. The IRS considers HOA fees as a rental expense which means you can write them off from your.

Everything is included Premium features IRS e-file Itemized Deductions. For example if youre self. However if you have an office.

If you rent your property out your HOA. Understand The Major Changes. Marion county jail inmate roster.

HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas. Ad Connect with Certified Legal Professionals Online and Save Time. Jun 04 2019 If the land is not rented and held for investment only the HOA fees.

With more people working from home than ever before some taxpayers may be wondering if they can claim a home office deduction when they file their 2020 tax return next. However if you have an office in your home that you use in. You can deduct certain expenses including HOA fees related to your home office.

For example if you utilize 10 of your home as an office 10 of your HOA fees are deductible. If your property is used for rental purposes the IRS considers. The quick answer to the question are HOA fees tax-deductible is.

My 14 year old daughter is pregnant. Best free government cell phone 2020. Unfortunately the answer isnt a straightforward one.

Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. Its important to note that as of 2018 the Tax Cuts and Jobs Acts only allows a home office deduction if you are self-employed. View solution in original.

When HOA Expenses Are Tax Deductible. With an office that takes. HOA fees are tax deductible as a rental expense for.

For example if you utilize 10 of your home as an office 10 of your HOA fees are deductible. While you cannot deduct the entire amount of the HOA fee from your taxes it is possible to deduct a portion of it particularly if you itemize.

How To Claim The Home Office Deduction With Form 8829 Ask Gusto

Tax Deductions For Home Office A Guide For Small Businesses

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service

Are Hoa Fees Tax Deductible In California Hvac Buzz

Who Can Claim Home Office Tax Deduction If They Worked From Home

Can You Take A Home Office Tax Deduction Virblife Com

The Definitive List Of 35 Home Business Tax Deductions

Anchor Tax Service Home Use Worksheet

Are Hoa Fees Tax Deductible Complete Guide Hvac Buzz

How You Can Make Money From Your Rental Show A Loss On Your Tax Return Semi Retired Md

Are Hoa Fees Tax Deductible Here S What You Need To Know

Can I Take The Home Office Deduction Free Quiz

Can I Write Off A Home Office Deduction For Delivery Or Rideshare

Are Hoa Fees Tax Deductible Complete Guide Hvac Buzz

Are Hoa Fees Tax Deductible Clark Simson Miller

8 Helpful Tax Deductions For Landlords

Calculating Your Home Office Expenses As A Tax Write Off Free Template Lin Pernille

Home Office Deduction Explained How To Write Off Home Office Expenses Save On Taxes Youtube

The Home Office Deduction For The Self Employed Independent Contractor Tax Advisors